Buy, Rent, or Punt? What Brands Need to Know About Virtual Land

As brands build out their metaverse strategies, new forms of experiential marketing are coming to life and sparking a lot of questions. What virtual worlds should we consider? How much should we budget? Is it better to buy or rent? Should we wait until the space becomes more established? The right answers are different for every brand and vary based on goals, target audience, and appetite for risk.

State of virtual land

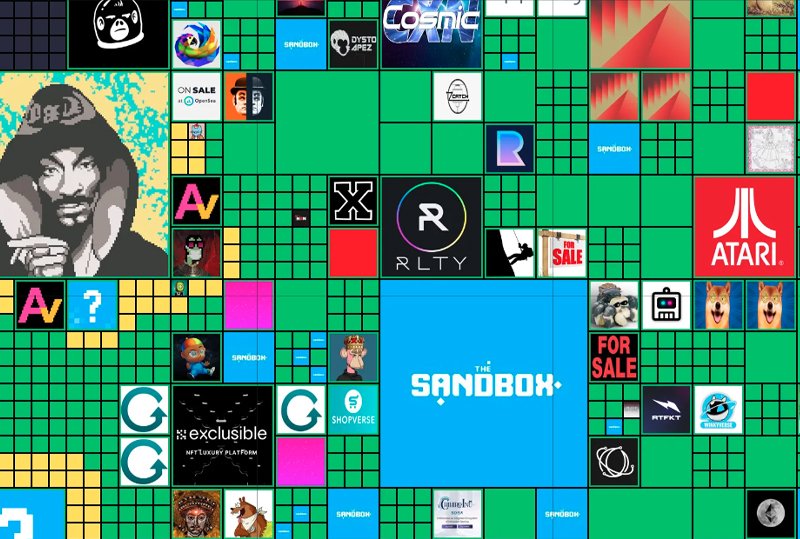

Over $500 million was spent on virtual real estate last year across the top four virtual worlds: The Sandbox, Decentraland, Cryptovoxels and Sominum Space. In January of this year alone, sales had already swelled to $85 million. At this pace, many expect revenue to reach $1 billion in 2022 then grow at a compound annual rate of 31% a year through 2028. The recent crypto correction may dampen those projections, creating a buying opportunity.

The lowest price for a parcel of land in the two largest platforms, The Sandbox and Decentraland has dropped from an average of $11,000 in January to $2,967 and $3,660 respectively. With the metaverse expected to host 5 billion people and be worth between $8-12 trillion by 2030, now may be one of the best times for brands to make their move.

How and where to buy?

Parcels at either The Sandbox or Decentraland can be purchased directly from marketplaces within each world using the local currency (SAND for The Sandbox and MANA for Decentraland) or through third-parties marketplaces like OpenSea where you can pay in Ethereum. To woo buyers to their world, Decentraland even offers a virtual mortgage with a 10% down payment.

Since none of us really know which virtual world will reign supreme, another option is to hedge your bets and rent, or rent to own. Firms like AdMix create and rent a variety of spaces from digital billboards to homes and retail spaces. They’ve also created virtual sculptures like oversized perfume bottles for L’Oreal and event-focused installations for the Cannes Film Festival, New York Fashion Week, and the FIFA World Cup. Renting is a low-cost way to test and learn while optimizing what can eventually be scaled up. On the downside, you miss out if home sales spike, just like IRL.

The Sandbox vs Decentraland

Owned by gaming company Animoca brands, The Sandbox is home to Gucci, Adidas, and Samsung along with celebrities like Snoop Dogg who is building the “Snoopverse” here, a digital recreation of his real-life California mansion where he plans to throw exclusive, members-only parties. In December, a parcel in the Snoopverse sold for $450k making it one of the most popular neighborhoods on the blockchain.

Parcels in The Sandbox are the equivalent of 96 meters by 96 meters in the real world – six times bigger than parcels in Decentraland. Unlike Decentraland however, which is browser-based, users need to download The Sandbox in order to play, making it more ideal for consumers who are active gamers and don’t mind a few extra onboarding steps in exchange for more advanced graphics.

Decentraland gained prominence this year when it hosted the Metaverse Fashion Week in March. Brands ranging from Etro, Tommy Hilfiger, Perry Ellis, Dolce & Gabbana and Estée Lauder among others held fashion shows, parties, pop-ups and talks for 108k attendees, driving one billion impressions in the process. The event was largely considered a successful proof of concept, bringing many in the fashion and beauty space into the metaverse for the first time. Some are now calling Decentraland a "metaverse beauty hub."

Virtual real estate firm the Metaverse Group, recently bought a piece of land in Decentraland for $2.43 million to host digital fashion events and sell virtual clothing for avatars. Financial services firm JP Morgan bought several parcels to open a lounge, complete with a portrait of founder Jamie Diamond and – because it’s the metaverse – a roaming tiger.

The most critical question

The biggest question brands have? Why buy virtual land in the first place? The answer is all about connecting with your customers in new ways and reaching younger audiences. It’s the same reason why it made sense to launch an Instagram account in 2014 or a Facebook page in 2009. It’s even the same reason why brands launched their own websites on the “information superhighway” in 1996. Brands that are future-focused, innovate ahead of the competition and create shared, memorable, first-of-their-kind experiences that deepen consumer relationships.

While it’s always possible to take a wait-and-see approach when it comes to buying or renting virtual real estate, there is an inherent risk here as well. Given the speed at which the metaverse is moving, brands that choose to stay on the sidelines now may find it tough to get in the game down the road.

Takeaway

As millions of consumers explore virtual worlds like The Sandbox and Decentraland and volatile pricing creates buying opportunities, the notion of owning virtual land holds increasing appeal. From opening flagship stores to hosting private parties for superfans at five-star virtual villas, moving to the metaverse makes sense for brands that want to break through.